Long-term investment in South America is building demand for PNW wheat

By Steve Mercer

This is the second in a series of articles describing how U.S. Wheat Associates (USW) is investing funds from the Washington Grain Commission (WGC) to maintain and grow demand for soft white (SW) and other classes of U.S. wheat in overseas markets. The partnership with the WGC, Oregon Wheat Commission, Idaho Wheat Commission, and 14 other state checkoff programs allows USW to apply for export market development funding from U.S. Department of Agriculture’s Foreign Agricultural Service programs.

That partnership has been working since the 1950s, yet ongoing export promotion remains vitally important to Pacific Northwest (PNW) wheat growers. For example,the U.S. exports an average of 55% of total annual SW production and carry-in stocks, and the percentage for Washington-grown SW is closer to 80%. From such products as sponge cakes, cookies, and pastries to blending with other wheat classes, SW wheat flour has the versatility to improve the quality of a wide variety of products in the top SW export markets of Southeast and North Asia, as well as growing opportunity in Latin America.

In this article, the focus is on export promotion strategies and successful activities in Latin American markets including Chile, Peru, and Colombia where the demand for cookies, crackers, and cakes is growing with disposable incomes and population.

PNW wheat opportunities

Because these markets are close to the Gulf of Mexico, soft red winter (SRW) wheat is the predominant soft wheat class moving to Latin American markets. However, USW is working to increase SW demand, especially in South America’s Pacific Coast markets.

Because these markets are close to the Gulf of Mexico, soft red winter (SRW) wheat is the predominant soft wheat class moving to Latin American markets. However, USW is working to increase SW demand, especially in South America’s Pacific Coast markets.

Chile is currently the largest SW market in South America, with USW making progress developing SW demand in Peru and Colombia. These markets remain price sensitive with an equally significant constraint relating to import logistics.

“Very few flour milling companies in our region have the capacity to import an entire vessel of wheat,” said USW Regional Director for South America Miguel Galdos. “That is why we are working hard to create and support opportunities for small buyers to pool purchases in combined cargoes. This approach addresses a challenge and opens prospects for growth and collaboration in the milling and baking industries.”

Building new demand

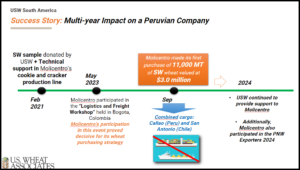

As an example, Galdos points to a multiyear effort with Molicentro, the largest cookie and cracker manufacturer in Peru. Under the Agricultural Trade Promotion program, USW donated a container load of SW to Molicentro in February 2021. USW made two, in-plant visits to provide milling and processing support that validated SW flour performance. Then in May 2023, Molicentro participated in a USW-sponsored logistics and freight workshop for South American wheat purchasing managers held in Bogota, Colombia.

“The information Molicentro gained there proved decisive for its U.S. wheat purchasing strategy,” said Galdos. “The company made its first ever purchase of 11,000 metric tons of soft white wheat in a combined cargo with another mill in Peru and one in Chile. It was a breakthrough with a $3 million return. And we recently heard the company has cooperated with an Ecuadoran miller to purchase an additional 10,000 metric tons of SW in a combined cargo with hard red winter and hard red spring that will load in July.”

Reviving steady demand in Chile

Sales of SW to Chile are steady for cookie production and for blending with hard wheat flour for French-style bread. USW’s 2023 work in this market was particularly important because millers imported much less of the drought-limited 2022 SW crop. Several Chilean millers attended USW’s 2023 workshop,including a purchasing group known as G9 that mainly imported Canadian wheat. Following the workshop, G9 started comparing moisture content between competing wheat supplies and incorporated new specifications favoring drier SW supplies. Also, in July 2023, G9 representatives joined other Chilean millers on a trade mission to Washington and other states to learn more about new crop U.S. wheat.

G9 responded to these trade service activities by increasing its SW imports from 4,400 metric tons to 34,500 metric tons (1.27 million bushels) in 2023 with an estimated return of $9 million to farmers and the grain trade.

Target Colombia

With its Pacific port in Buenaventura, Colombia is an opportunity market for PNW wheat. To address the challenge that 90% of the wheat entering the Pacific port has been Canadian, USW took an innovative opportunity to shape future demand through a HRW Food for Progress monetization program in 2023. The monetized HRW introduced a viable alternative to Canadian spring wheat for bread and pasta production in the western region. One of the buyers was the country’s largest wheat importer, Harinera del Valle (HDV), that has received substantial trade and technical service from USW with the direct support of PNW state wheat commissions. HDV had received two container loads of SW in 2020 and asked USW for technical support using U.S. soft wheat for cookie flour in 2022. Representatives from HDV also visited Idaho in July 2023 as part of a Colombian trade team.

The effort to promote load-outs of U.S. wheat from the PNW will continue in marketing year 2024-25.

The next article in this series looks at traditionally strong markets for PNW wheat in the North Asian countries of Japan, Taiwan, and South Korea.

This article originally appeared in the July 2024 issue of Wheat Life Magazine.

Steve Mercer

Steve Mercer is the vice president for communications for the U.S. Wheat Associates and a contributing author to Wheat Life Magazine.